A property tax increase is on the table as Town of Rocky Mountain House council and administration is set to bear down for two intensive days of hashing out the budget for the upcoming year.

Acting Mayor Len Phillips is expressing confidence going into the deliberations, though he says a tax increase is a possible outcome.

The draft budget the town is currently working with calls for a two per cent property tax increase, Phillips says.

Though he says that increase is below the rate of inflation which is currently well above three per cent.

Additionally, some money will need to be set aside to accomplish some priorities identified in the town’s recently adopted 2024-2026 Strategic Plan. Phillips says those include development incentives, and shovel-ready plans for infrastructure when provincial and federal grants become available.

Phillips adds, capital costs and utility rates will need to be considered with the town’s $31 million waste water treatment plant set to come online in the near future.

Much work has gone into the draft budget to keep any tax increase low, says Phillips, including a three-day service level review earlier in the year, which revealed the town offers 369 services— both mandatory and discretionary.

Earlier in the fall, town council heard a budget assumption presentation which predicted a 4.2 per cent revenue increase that would potentially be required to raise an additional $410,000.

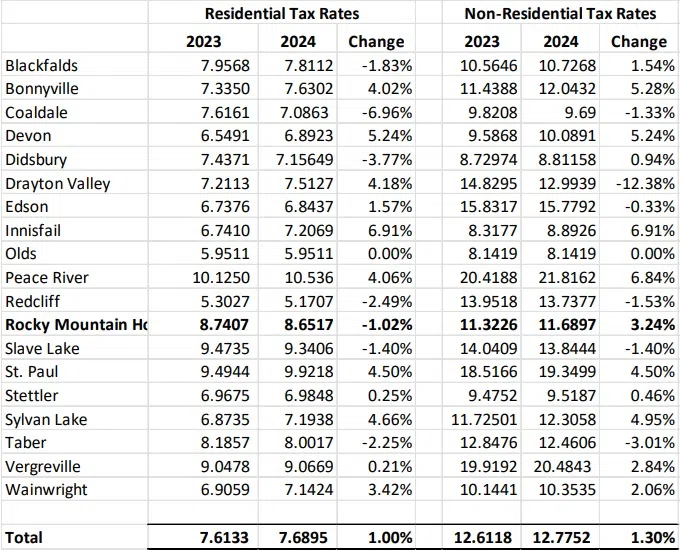

A table shows that Rocky Mountain House’s current residential property tax rate of 8.65 per cent is higher than similar-sized communities such as Sylvan Lake, but lower than communities such as Vegreville and St. Paul.

Previous analyses have shown that Rocky offers a relatively high level of services such as recreation and protective services, thus the slightly higher-than-average property tax rate.

Source: Town of Rocky Mountain House

Many municipalities are grappling with property tax increases to get back on track following pandemic era disruptions, such as Red Deer which recently approved a 10.5 per cent property tax increase.

One year ago, council approved the 2024 operating budget of $26,886,633 and capital budget of $6,683,200.

That budget included a four per-cent increase in property tax revenue. It was expected to generate $376,000 more in municipal property tax revenue for 2024.

The 2024 budget also anticipated the town raising over $1.5M in franchise fees. In October, council passed a motion to increase the Fortis franchise fee by 1.5 per cent to a rate of 16.8 per cent while leaving the ATCO rate unchanged.

Calculations showed a 1 per cent increase in the ATCO rate would result in around $24,194 in additional revenue.

Budget deliberations happen at town office Nov. 27-28.

–

READ MORE:

- Report: Town of Rocky Mountain House provides 369 programs at service level

- Town of Rocky Mountain House running surplus budget first six months of 2024

- Budget preview shows town may need to find $410,000 in additional revenue

- Town to generate more revenue from electricity tariff

- Town of Rocky Mountain House adopts 2024 budget

- Town of Rocky Mountain House 2023 financial report: highlights

- Rocky Mountain House town council passes tax incentive bylaw

- Council adopts ‘five pillars’ of 2024-2026 strategic plan

–

Comments